Vancouver home sales return to more traditional levels in April

Home buyer demand in Metro Vancouver returned to more historically typical levels in April.

The Real Estate Board of Greater Vancouver (REBGV) reports that residential home sales in the region totalled 3,232 in April 2022, a 34.1 per cent decrease from the 4,908 sales recorded in April 2021, and a 25.6 per cent decrease from the 4,344 homes sold in March 2022.

Last month’s sales were 1.5 per cent above the 10-year April sales average.

“So far this spring, we’ve seen home sales ease down from the record-breaking pace of the last year,” Daniel John, REBGV Chair said. “While a small sample size, the return to a more traditional pace of home sales that we’ve experienced over the last two months provides hopeful home buyers more time to make decisions, secure financing and perform other due diligence such as home inspections.”

There were 6,107 detached, attached and apartment properties newly listed for sale on the Multiple Listing Service® (MLS®) in Metro Vancouver in April 2022. This represents a 23.1 per cent decrease compared to the 7,938 homes listed in April 2021 and an 8.5 per cent decrease compared to March 2022 when 6,673 homes were listed.

The total number of homes currently listed for sale on the MLS® system in Metro Vancouver is 8,796, a 14.1 per cent decrease compared to April 2021 (10,245) and a 15.3 per cent increase compared to March 2022 (7,628).

“With interest rates climbing and the total inventory of homes for sale inching higher, it’s important to work with your local Realtor to understand how these factors could affect your home buying or selling situation,” John said.

For all property types, the sales-to-active listings ratio for April 2022 is 36.7 per cent. By property type, the ratio is 25.3 per cent for detached homes, 47.1 per cent for townhomes, and 45 per cent for apartments.

Generally, analysts say downward pressure on home prices occurs when the ratio dips below 12 per cent for a sustained period, while home prices often experience upward pressure when it surpasses 20 per cent over several months.

The MLS® Home Price Index composite benchmark price for all residential properties in Metro Vancouver is currently $1,374,500. This represents an 18.9 per cent increase over April 2021 and a one per cent increase compared to March 2022.

Sales of detached homes in April 2022 reached 962, a 41.9 per cent decrease from the 1,655 detached sales recorded in April 2021. The benchmark price for a detached home is $2,139,200. This represents a 20.8 per cent increase from April 2021 and a one per cent increase compared to March 2022.

Sales of apartment homes reached 1,692 in April 2022, a 26.1 per cent decrease compared to the 2,289 sales in April 2021. The benchmark price of an apartment home is $844,700. This represents a 16 per cent increase from April 2021 and a 1.1 per cent increase compared to March 2022.

Attached home sales in April 2022 totalled 578, a 40 per cent decrease compared to the 964 sales in April 2021. The benchmark price of an attached home is $1,150,500. This represents a 25 per cent increase from April 2021 and a 1.1 per cent increase compared to March 2022.

Download the April 2022 stats package.

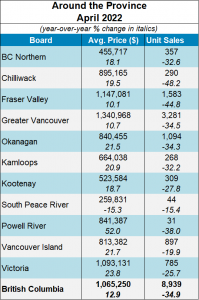

As for the rest of the province:

BC Home Sales Trending Toward Normal Activity

Vancouver, BC – May 12, 2022. The British Columbia Real Estate Association (BCREA) reports that a total of 8,939 residential unit sales were recorded by the Multiple Listing Service® (MLS®) in April 2022, a decrease of 34.9 per cent from a record April 2021. The average MLS® residential price in BC was $1.065 million, a 12.9 per cent increase from $943,765 recorded in April 2021. Total sales dollar volume was $9.5 billion, a 26.5 per cent decline from the same time last year.

“Canadian mortgages have sharply increased, surpassing 4 per cent for the first time in a decade,” said BCREA Chief Economist Brendon Ogmundson. “With interest rates rising, demand across BC is now on a path to normalizing. However, given existing levels of supply, markets conditions remain tight.”

Provincial active listings were 7.5 per cent lower than this time last year, though listings are starting to accumulate in some markets as demand fades. However, it will likely take a year or more for the supply of listings to return to balanced market levels.

Year-to-date, BC residential sales dollar volume was down 10.7 per cent to $38.4 billion, compared with the same period in 2021. Residential unit sales were down 24.2 per cent to 35,618 units, while the average MLS® residential price was up 17.8 per cent to $1.078 million.