Low supply keeps upward pressure on home prices across Metro Vancouver’s housing market

The first month of 2022 saw home sales come down from last year’s record-setting pace, while low supply continued to cause home prices to edge higher across Metro Vancouver.

The Real Estate Board of Greater Vancouver (REBGV) reports that residential home sales in the region totalled 2,285 in January 2022, a 4.4 per cent decrease from the 2,389 sales recorded in January 2021, and a 15 per cent decrease from the 2,688 homes sold in December 2021.

Last month’s sales were 25.3 per cent above the 10-year January sales average.

There were 4,170 detached, attached and apartment properties newly listed for sale on the Multiple Listing Service® (MLS®) in Metro Vancouver in January 2022. This represents a 6.9 per cent decrease compared to the 4,480 homes listed in January 2021 and a 114.4 per cent increase compared to December 2021 when 1,945 homes were listed.

“Our listing inventory on MLS® is less than half of what would be optimal to begin the year. As a result, hopeful home buyers have limited choice in the market today. This trend is causing fierce competition for a scarce number of homes for sale, which, in turn, increases prices,” Keith Stewart, REBGV economist said.

The total number of homes currently listed for sale on the MLS® system in Metro Vancouver is 5,663, a 31.8 per cent decrease compared to January 2021 (8,306) and an 8.2 per cent increase compared to December 2021 (5,236).

“As we approach spring, we’ll keep a close eye on the impact of rising interest rates on buyers’ willingness to buy and on whether more home owners will opt to become sellers in what’s traditionally the busiest season of the year,” Stewart said. “With home prices reaching new highs in recent months, the need has never been greater for government to collaborate with the building community to expedite the creation of housing supply and provide more choice for those struggling to buy a home today.”

For all property types, the sales-to-active listings ratio for January 2022 is 40.3 per cent. By property type, the ratio is 28 per cent for detached homes, 51.6 per cent for townhomes, and 49.7 per cent for apartments.

Generally, analysts say downward pressure on home prices occurs when the ratio dips below 12 per cent for a sustained period, while home prices often experience upward pressure when it surpasses 20 per cent over several months.

The MLS® Home Price Index composite benchmark price for all residential properties in Metro Vancouver is currently $1,255,200. This represents a 18.5 per cent increase over January 2021 and a two per cent increase compared to December 2021.

Sales of detached homes in January 2022 reached 622, a 15.9 per cent decrease from the 740 detached sales recorded in January 2021. The benchmark price for a detached home is $1,953,000. This represents a 22.7 per cent increase from January 2021 and a 2.2 per cent increase compared to December 2021.

Sales of apartment homes reached 1,315 in January 2022, a 10 per cent increase compared to the 1,195 sales in January 2021. The benchmark price of an apartment property is $775,700. This represents a 14 per cent increase from January 2021 and a 1.8 per cent increase compared to December 2021.

Attached home sales in January 2022 totalled 348, a 23.3 per cent decrease compared to the 454 sales in January 2021. The benchmark price of an attached home is $1,029,500. This represents a 24.3 per cent increase from January 2021 and a 2.5 per cent increase compared to December 2021.

Download the January 2022 stats package

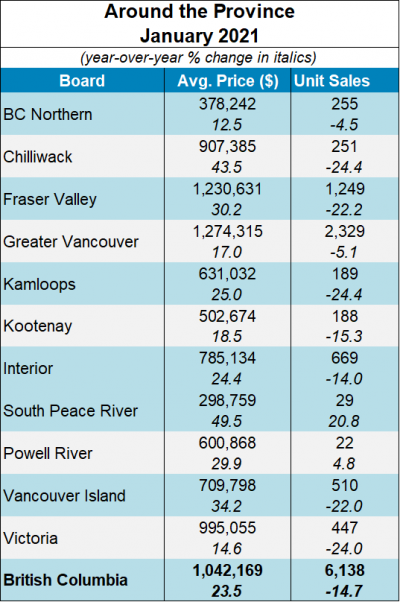

As for the rest of the province:

Extremely Tight Conditions Persist in the BC Housing Market

Vancouver, BC – February 14, 2022. The British Columbia Real Estate Association (BCREA) reports that a total of 6,138 residential unit sales were recorded by the Multiple Listing Service® (MLS®) in January 2022, a decrease of 14.7 per cent from January 2021. The average MLS® residential price in BC was $1,042,169, a 23.5 per cent increase from $843,918 recorded in January 2021. Total sales dollar volume was $6.4 billion, a 5.3 per cent increase from the same time last year.

“Sales activity is down compared to record levels at the start of last year,” said BCREA Chief Economist Brendon Ogmundson. “However, the level of sales activity remains strong compared to the long-term average and inventory is still incredibly low. As a result, it will take quite some time to get back to healthy balance in the BC market.”

Total active listings remain near record lows with just 13,000 total listings in the province. For context, a healthy level of re-sale listings for the province is closer to 40,000 listings. As a result of this listings drought, markets all over the province are seeing significant upward pressure on prices.